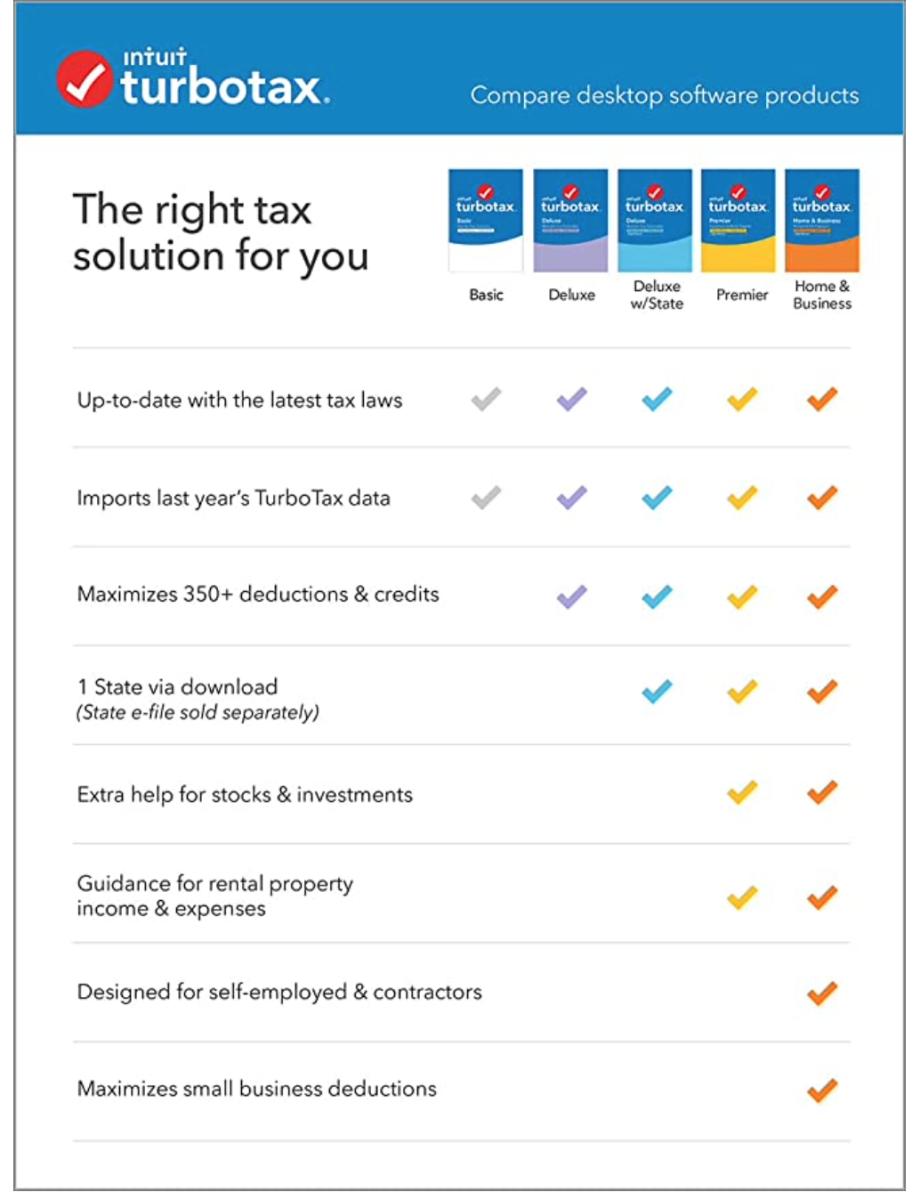

TurboTax Business Edition is more suitable for the following: You're able to enter more than one source of income. The TurboTax program offers suggestions on deductions that self-employed people usually take, such as vehicle and home office deductions.

WHICH TURBOTAX FOR S CORP INCOME DRIVERS

Independent contractors, such as Uber drivers.The following individuals may find TurboTax Self-Employed Edition an ideal tax software: Typically, these products are easy to use and inexpensive. The following are a few popular tax software providers for small- to medium-sized businesses, independent contractors, freelancers, and sole proprietors. Transferring payroll data to payroll tax forms.This program makes handling payroll easier and more convenient by automating: You also include your share of FICA taxes on the form.įor S corporations who have shareholders as salaried employees, the payroll software Gusto is highly recommended for small businesses. You file form 941 every quarter to report tax withholding information from employee paychecks, specifically FICA taxes and income tax. You file form 940 annually to report unemployment tax payments. You report payroll taxes on forms 940 and 941. Schedule K-1 is issued to company shareholders, and it reports the amount of company profits that passes through to the owners.&.Form 1120S reports all of the business's credits, income, losses, and deductions.For S corporations who employ shareholders who earn a salary, the business is responsible for payroll taxes, too.& If you operate an S corporation, you're responsible for filing form 1120S and Schedule K-1. S corporation tax software is useful for small business owners who need to prepare and file taxes without hiring a CPA.

0 kommentar(er)

0 kommentar(er)